Before jumping into the process of getting a top up loan at MoneyView it is important to know what we mean by a top up loan. A top up loan is an additional loan amount which you may borrow on top of your present loan. If you have taken out a personal loan and have had a good track record of paying it back on time, lenders will usually allow you to take out an extra amount as a top up. This is very useful when you require money but do not wish to go through the full application process for a new loan. At MoneyView the top up loan is made available to customers to allow them to borrow quickly without going through multiple document requests or complex formalities.

Why do you choose to use MoneyView for your top up loan?

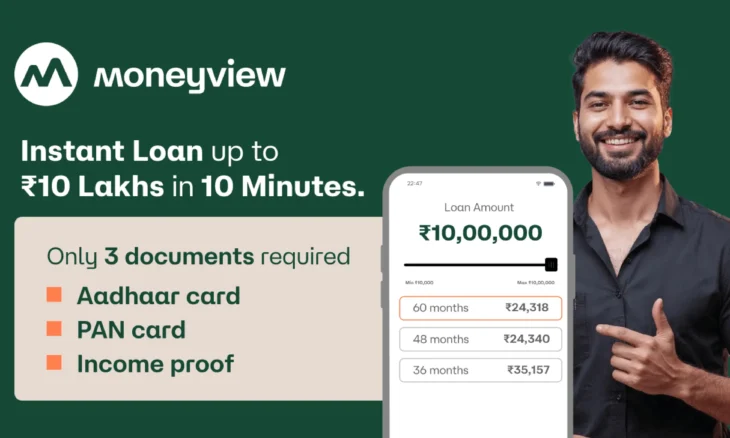

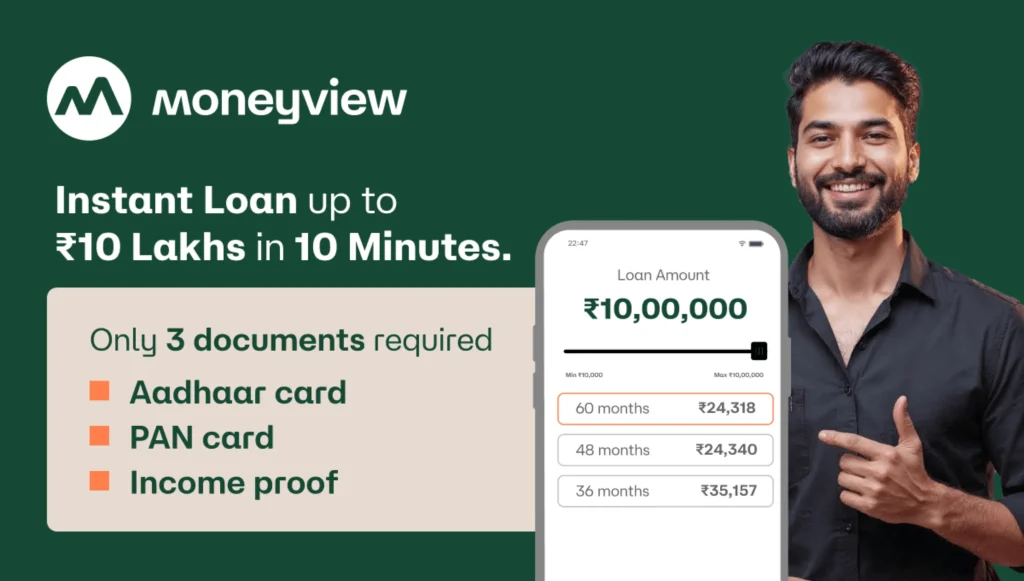

MoneyView has become a trusted digital lending platform we stand by that which is in its quick approval and smooth processes. Also a reason why many go to MoneyView for their top up loans is the ease of use we provide. We differ from traditional banks which have extensive paper work and many visits which is the norm, we go digital and simple.

Our rates are competitive and we offer flexible repayment terms which in turn makes it easy for our borrowers to manage their finance. Also since your credit history with us is via your present loan, your chances of getting that top up loan approved are much higher than if you applied for a fresh loan with some other company.

Eligibility Requirements for Top-Up Loan at MoneyView.

When it comes to top up loans MoneyView does check your payment history and what we would term financial discipline. What we see is that which borrowers who have made timely EMI payments and have had a great experience with us are more likely to get approved. While your credit score is a factor in the mix for you as a customer we know you are with us already which makes the process of evaluation go smoother and faster. In many cases we at MoneyView proactively reach out to our eligible customers via the app or SMS with info on the top up loan we are offering. Which means that if you are doing well by paying on time you may already be preapproved for a top up loan before you apply.

Importance of Repayment History

Repayment record is what MoneyView looks at mostly before they grant a top up loan. If you have always paid on time which may include a little before the due date, that is a plus point in your favor. Also if you’ve missed a payment or have delayed it in the past that will work against you. Also the company does a great deal of digital credit assessment which means each EMI you make is an asset to your case for more borrowing.

Step by step guide for getting a top up loan at MoneyView.

Step 1: Check if you qualify.

First up you will need to log into the MoneyView app with your registered mobile number. Upon access, check if you have a pre approved top up loan which is available for you. MoneyView typically will notify eligible customers via the app or SMS. If you see a “Top Up Loan Available” option that is your sign that you are a candidate.

Step 2: Check out the Loan Offer.

Click through the top up loan notice to see out the terms which include the loan amount, interest rate, and payment term. At MoneyView we are very transparent so you will see precisely how much you are able to borrow from us and what your EMI will be before you accept the offer.

Step 3: Provide what is current as of today’s date which is required.

In most cases we do not have to re submit documents since MoneyView has your KYC and income proof. But at times the app may ask for an updated bank statement or income proof which you can very well upload within the app.

Step 4: Accept the challenge.

Once you approve the terms, you may accept the loan offer at the click of a button. MoneyView will process your request almost right away. Also it is possible that the platform will rework your present EMIs by including them with the new top up loan amount which in turn will be reflected in your payment schedule.

Step 5: Receive Payment into your account.

Upon approval the loan amount is put into your registered bank account. This process usually takes a few hours which also includes the speediest way to access extra funds without the need to apply for a new loan at a different institution.

Step 6: Track and Pay for it with MoneyView App.

Once your top-up is given out, we have updated your EMI plan in the MoneyView app. You may track your payments, see your balance due and take care of your loan all from within the app.

Through the MoneyView App for Easy Processing.

The MoneyView app is at the core of our simplified top up loan process. You can check your eligibility, repayment schedule and outstanding balance in the same place. For top up loans we have made the app a one stop solution which allows you to not only apply but also manage the new EMI structure. As the top up amount goes towards your primary loan balance the app in turn will update your repayment schedule to reflect the combined EMI.

Benefits of a Top-Up Loan in MoneyView.

In MoneyView what we see is that there is great convenience in taking out a top-up loan. As an existing borrower with us that convenience is almost instant. Also you do not have to stress over extra paperwork or going around getting signatures. Also it is the case that top up loans we offer come in at the same or a very competitive interest rate to what you are paying now which in turn makes this option more cost effective than should you go to a different lender for a personal loan.

Also with MoneyView we have flexible repayment tenures which in turn means you may choose a pay back plan that best suits your financial state. Also we have in this that the flexibility of the plan which in turn keeps your EMIs at an affordable rate even when we add in the new loan amount. Also a great aspect is that the app does a great job of putting all the info out there for you before you accept the offer we are talking interest rates, EMI’s and total repayment amount which also covers you from surprise charges at a later date.

Financial Flexibility with a Top-Up Loan

A top up loan is a good solution for that unexpected financial issue which in turn does not touch your savings. If what you require is to pay for health issues, home renovation, educational fees out of it or also to combine present debts, MoneyView’s top up loan is a practical choice. Also the funds are deposited into your bank account which in turn you may use as you see fit. This feature of flexibility which eliminates the use of the loan for pre determined purposes makes it very attractive to the borrowers.

Conclusion

Getting into the money via the MoneyView top up option is the easiest way to get extra funds at which you do not have to go through the full loan application process again. We have that they require little documentation, fast turn around for approvals and very transparent terms which in turn makes borrowers’ experience with them for financial needs a very good one. Maintaining good repayment discipline and a healthy financial record increases your chances of getting pre-approved offers for top-up loans. Whether you are facing an emergency or simply need funds for planned expenses, the top-up loan facility in MoneyView provides an efficient, fast, and reliable solution.

Author Profile

- I am the owner of the blog readree.com. My love for technology began at a young age, and I have been exploring every nook and cranny of it for the past eight years. In that time, I have learned an immense amount about the internet world, technology, Smartphones, Computers, Funny Tricks, and how to use the internet to solve common problems faced by people in their day-to-day lives. Through this blog, I aim to share all that I have learned with my readers so that they can benefit from it too. Connect with me : Sabinbaniya2002@gmail.com

Latest entries

HealthFebruary 16, 2026Dentist Salary in India: Average Pay and Growth Opportunities

HealthFebruary 16, 2026Dentist Salary in India: Average Pay and Growth Opportunities BlogFebruary 16, 2026A Plain-English Look at How Modern Logistics Works

BlogFebruary 16, 2026A Plain-English Look at How Modern Logistics Works ArticleFebruary 9, 2026Lessons Learned from Managing More Than You Can Carry

ArticleFebruary 9, 2026Lessons Learned from Managing More Than You Can Carry ArticleJanuary 27, 20265 Practical Ideas for Office Swag That Boosts Moral

ArticleJanuary 27, 20265 Practical Ideas for Office Swag That Boosts Moral